Roth Conversions, It's Not Just About Taxes

Jeff Martin is a financial advisor at Cornerstone based in Reno, NV. Jeff has earned the Life and Health Insurance Licensure and has passed the Series 65 examination. He enjoys being able to help clients create customized strategies for their portfolios based on their unique financial goals.

ROTH CONVERSIONS, IT’S NOT JUST ABOUT TAXES

The idea of ROTH conversions in its simple form is moving funds from the taxable side of the fence to the non-taxable side. Of course, taxes are generated as the funds “hop the fence,” meaning that when funds leave your IRA to be converted to a ROTH, the amount distributed is taxed as income. If this is done effectively, the result is less tax being paid long term.

We currently have a great window of opportunity to seriously consider this for two main reasons. First, we know taxes are going to increase in the future. If tax laws stay as they currently are, we have a few years at best before we see an increase in taxes, so if you can pay a smaller amount now, progress is being made. Secondly, the markets are currently down. No one particularly enjoys this environment, but a silver lining is the conversion opportunity. By executing a ROTH conversion in a pressured environment, the funds are moved to the ROTH at their current value, and when the markets recover, that growth will be realized tax-free in your ROTH.

A general rule of thumb is to initially approach this as tax bracket management. Meaning, how much “room” do you have remaining in your current bracket to the top of it after all your other income sources are taken into account. The difference is a good place to start as your “conversion allowance.” Once this is determined, it is just a matter of deciding how much of that room you want to utilize, and how aggressive you would like to be.

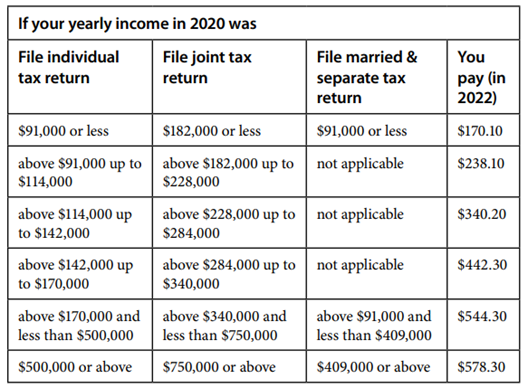

There is one other component that is often overlooked, and that is the Medicare premium income thresholds. Not only does your total income determine which tax bracket you will fall into, but it determines how much you will be paying for your Medicare premiums at age 65 and beyond. The higher the income, the higher the premiums. Medicare has a two-year look back, meaning your income from two years prior dictates your premium amount for the current year. Much like the tax brackets, these are tiered. I included a graph to the right outlining the 2022 income thresholds as a reference.

If ROTH conversions are executed too aggressively, not only could you be paying more tax making them less or completely ineffective, but you can also substantially increase your Medicare premium costs as well. As I have shared before, each situation is as unique as a fingerprint, as such, taking a very aggressive approach in one situation may make a lot of sense, while it would be entirely counterproductive in another.

I encourage you to have a conversation with your advisor and tax professional to determine what “conversion allowance” you have, and how much should be utilized, especially given the fleeting window of opportunity that we currently have.

At Cornerstone, we use tax strategies like ROTH conversions to reduce our clients’ taxes in retirement. In fact, we have created a Cornerstone Retirement Tax Savings Analysis designed to show you how you may be able to dramatically reduce your taxes in retirement. If this interests you, call our office at 775.853.9033 to schedule an appointment with our team.

Based in Reno, NV, Cornerstone is for individuals and families looking to grow wealth, protect and preserve their life savings, and plan for the distribution of their estate in a tax-efficient manner through a tailored strategy. Schedule a time to discuss your financial goals with us.